“Effect of Fiscal and Monetary Policy Coordination on the Economy”

Introduction

- Definition of fiscal and monetary policy:

- Fiscal policy refers to government spending and taxation decisions aimed at influencing the economy.

- Monetary policy refers to the central bank’s actions, such as controlling interest rates and money supply, to stabilize the economy.

- Thesis statement:

- Fiscal and monetary policies, when coordinated effectively, can enhance economic stability, foster growth, reduce unemployment, and control inflation. However, misalignment between the two can create economic instability.

Overview of Fiscal and Monetary Policies

- Fiscal Policy:

- Government spending and taxation: How governments use taxation to regulate economic demand and public spending to stimulate or contract the economy.

- Objectives of fiscal policy: Promote economic growth, reduce unemployment, and manage inflation.

- Examples of fiscal policy actions: Stimulus packages, tax cuts, government investment in infrastructure, or austerity measures.

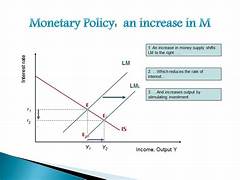

- Monetary Policy:

- Central bank operations: The role of central banks in controlling the money supply and setting interest rates to influence economic conditions.

- Objectives of monetary policy: Achieve price stability, control inflation, and support employment.

- Examples of monetary policy actions: Changing interest rates, engaging in open market operations, and altering reserve requirements.

The Need for Coordination

- Economic stability requires a unified approach: The interplay between fiscal and monetary policies can either complement each other or conflict, leading to different economic outcomes.

- Why coordination matters: When fiscal policy (government spending) and monetary policy (central bank control of money) are aligned, they can effectively support economic growth and stabilize inflation.

Effects of Fiscal and Monetary Policy Coordination on the Economy

- Stimulating Economic Growth

- Boosting aggregate demand: Coordinated fiscal and monetary policies can create a synergy that boosts demand in the economy.

- Fiscal expansion and monetary easing: A combination of increased government spending and lower interest rates can help stimulate investment and consumption, leading to higher GDP growth.

- Reducing Unemployment

- Increasing aggregate demand through fiscal stimulus: Higher government spending, particularly on infrastructure projects, can lead to more job creation.

- Monetary easing’s role: Lower interest rates make borrowing cheaper for businesses, encouraging investment and leading to higher employment.

- Managing Inflation

- Balancing inflation with fiscal control: Fiscal policy, such as reducing government spending or raising taxes, can help curb inflation when the economy is overheating.

- Monetary policy’s role in inflation control: Tightening the money supply and increasing interest rates can reduce inflationary pressures by making borrowing more expensive and slowing down economic activity.

- Complementary actions: Coordinated tightening of both fiscal and monetary policy can prevent runaway inflation.

- Enhancing Confidence in the Economy

- Clear signaling to markets and consumers: When fiscal and monetary policies are in sync, it helps create a stable environment, boosting consumer and investor confidence.

- Predictable policy outcomes: Coordination reduces uncertainty, leading to more stable long-term expectations and economic planning.

Risks of Poor Fiscal and Monetary Policy Coordination

- Contradictory Policy Effects

- Fiscal stimulus vs. tight monetary policy: A government stimulus program (increasing spending) paired with higher interest rates (a restrictive monetary policy) can lead to ineffective outcomes, such as inflation without economic growth.

- Impact on inflation and unemployment: Poor coordination can lead to a situation where inflation rises while unemployment remains high.

- Market Uncertainty

- Conflicting signals: If fiscal and monetary authorities send mixed signals about their economic priorities, it can cause confusion and hinder decision-making by businesses and investors.

- Loss of policy credibility: Inconsistent actions could reduce the public’s trust in government institutions, leading to less effective policy interventions.

- Potential for Economic Distortion

- Market interference: Excessive government spending combined with loose monetary policy may lead to asset bubbles, unsustainable debt, and long-term fiscal challenges.

- Monetary over-reliance: Central banks using monetary policy alone may fail to address structural economic problems, leaving fiscal policy as a neglected tool.

Case Studies of Fiscal and Monetary Policy Coordination

- The United States during the Great Recession (2008-2009)

- Coordinated response: The U.S. government increased fiscal spending through stimulus packages while the Federal Reserve lowered interest rates and engaged in quantitative easing.

- Effectiveness: This coordination helped pull the U.S. economy out of a deep recession, reducing unemployment and stabilizing the financial system.

- European Union and the Eurozone Debt Crisis (2010-2012)

- Poor coordination during the crisis: While monetary policy (interest rates) was under the European Central Bank (ECB), fiscal policies were controlled by individual member states, leading to conflicting actions (e.g., austerity vs. growth-oriented measures).

- Impact on the economy: The lack of effective fiscal coordination with the ECB’s monetary policy led to prolonged recession and high unemployment across several European countries.

- Japan’s Economic Struggles and “Abenomics” (2012-present)

- Abenomics’ approach: A combination of aggressive fiscal stimulus (increased government spending) and monetary easing (quantitative easing by the Bank of Japan).

- Effectiveness: The policies have helped stabilize Japan’s economy but have faced challenges with long-term growth and rising public debt.

The Role of Global Cooperation

- Global economic interdependence: In an interconnected global economy, coordinated fiscal and monetary policies between countries can help stabilize the international economy, especially during global downturns.

- International organizations’ roles: Institutions like the International Monetary Fund (IMF) and the World Bank promote coordination among nations’ fiscal and monetary policies to prevent financial crises and promote sustainable growth.

- Coordinating in times of crisis: International coordination, such as during the COVID-19 pandemic, can be critical in addressing global economic challenges.

Challenges to Effective Coordination

- Political Pressures

- Conflicting political priorities: Different political factions may push for opposing fiscal and monetary policies, making coordination difficult.

- Short-term vs. long-term focus: Governments may prioritize short-term stimulus over long-term fiscal health, leading to misalignment with monetary policy.

- Inflation and Deflation Risks

- Inflationary pressures: In times of economic recovery, coordinated policies could lead to inflation if not carefully managed.

- Deflation concerns: In some economies (e.g., Japan), excessive reliance on monetary easing without complementary fiscal policies could lead to deflation and stagnation.

- Structural and Institutional Limitations

- Independent central banks: In some countries, central banks operate independently of the government, making coordination with fiscal policy more complex.

- Inflexible fiscal policies: Governments may face constraints on fiscal action due to political, legal, or institutional limitations.

Conclusion

- Summary of key points: Effective coordination between fiscal and monetary policies is crucial for achieving economic stability, growth, and low inflation.

- The need for flexibility and adaptability: Policymakers must remain flexible and responsive to economic conditions, ensuring that fiscal and monetary policies are aligned to address emerging economic challenges.

- Final thoughts: While coordination brings immense potential for economic growth, careful management is essential to avoid conflicts, ensure long-term stability, and adapt to unforeseen economic shocks.