Roles of Monetary Policy in Controlling Inflation

Introduction

Inflation is a crucial economic phenomenon that impacts purchasing power, cost of living, and overall economic stability. Monetary policy, managed by central banks such as the Federal Reserve in the U.S. or the European Central Bank, plays a key role in controlling inflation. By adjusting interest rates, regulating money supply, and implementing financial policies, central banks aim to maintain price stability and foster sustainable economic growth. This article explores the mechanisms, effectiveness, and challenges of monetary policy in controlling inflation.

1. Understanding Inflation and Its Causes

Inflation refers to the general increase in the prices of goods and services over time. Several factors contribute to inflation, including:

- Demand-pull inflation: When demand for goods and services exceeds supply, driving up prices.

- Cost-push inflation: When production costs rise (e.g., due to higher wages or raw material prices), leading businesses to increase prices.

- Monetary inflation: When excessive money supply growth leads to devaluation of currency and higher prices.

2. Objectives of Monetary Policy

The primary objectives of monetary policy in controlling inflation include:

- Price Stability: Ensuring that inflation remains within a target range to avoid economic disruptions.

- Economic Growth: Facilitating a stable environment for investment and employment.

- Exchange Rate Stability: Maintaining confidence in the currency by preventing excessive inflation or deflation.

- Financial Stability: Preventing bubbles and economic crises through effective monetary regulation.

3. Tools of Monetary Policy in Controlling Inflation

Central banks use various monetary policy tools to influence inflation levels:

a. Interest Rate Adjustments

- Raising interest rates: Higher interest rates make borrowing more expensive, reducing consumer spending and investment, thereby lowering inflation.

- Lowering interest rates: This stimulates economic activity but may increase inflation if used excessively.

b. Open Market Operations (OMO)

- Buying or selling government securities to regulate money supply.

- Selling securities: Reduces money supply and controls inflation.

- Buying securities: Increases money supply, potentially boosting inflation in recessionary periods.

c. Reserve Requirements

- Higher reserve requirements: Banks hold more funds, reducing lending capacity, which helps curb inflation.

- Lower reserve requirements: Encourages lending, stimulating economic growth.

d. Inflation Targeting

- Many central banks set explicit inflation targets (e.g., 2%) and adjust policies to meet these targets, ensuring predictable economic conditions.

4. Effectiveness of Monetary Policy

While monetary policy is a powerful tool, its effectiveness depends on:

- Timing and Implementation: Delays in policy effects can lead to economic imbalances.

- Global Economic Factors: External factors like oil price shocks or geopolitical tensions can influence inflation beyond central bank control.

- Public Expectations: If businesses and consumers expect inflation, they may act in ways that reinforce price increases.

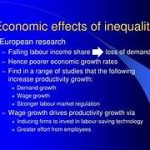

5. Challenges in Controlling Inflation

Monetary policy faces several challenges, including:

- Stagflation: A combination of high inflation and high unemployment, making monetary interventions difficult.

- Liquidity Traps: When interest rates are already low, reducing them further may not stimulate growth.

- Income Inequality: Tight monetary policy can disproportionately affect lower-income groups by reducing job opportunities and access to credit.

6. Case Studies on Monetary Policy and Inflation

a. The Volcker Era (1980s)

- Federal Reserve Chairman Paul Volcker implemented aggressive interest rate hikes to combat high inflation in the U.S., successfully reducing inflation but causing a short-term recession.

b. Japan’s Deflation Struggles

- Japan has faced prolonged low inflation and deflation despite monetary easing, highlighting the difficulty of managing inflation expectations.

c. The European Central Bank’s Approach

- The ECB employs inflation targeting and interest rate adjustments to maintain price stability in the Eurozone.

7. Future Outlook and Recommendations

Looking ahead, central banks must adapt to evolving economic challenges, including:

- Digital Currencies: Potential impact of central bank digital currencies (CBDCs) on monetary policy effectiveness.

- Climate Change Policies: Rising costs due to environmental regulations may necessitate new inflation control strategies.

- Globalization Effects: Cross-border trade and investment flows influence domestic inflation trends.

Conclusion

Monetary policy remains a critical instrument for controlling inflation and ensuring economic stability. While central banks have various tools at their disposal, balancing inflation control with economic growth requires careful consideration. As economies evolve, monetary authorities must adopt innovative strategies to address new challenges and maintain long-term stability.