“Impacts of Government Spending on Economic Growth: An Empirical Analysis”

Introduction

- Definition and Importance of Government Spending:

- Government spending refers to the expenditure by the state on goods, services, and infrastructure, which is financed primarily through taxation and borrowing.

- It plays a crucial role in shaping the economy by influencing aggregate demand, employment levels, inflation, and the general economic climate.

- Thesis Statement:

- Government spending can stimulate economic growth in the short term by boosting aggregate demand and creating jobs, but its long-term effects depend on the composition, efficiency, and sustainability of spending policies. This article will examine empirical evidence on the impacts of government spending on economic growth.

Overview of Government Spending

- Types of Government Spending:

- Consumption Spending: Government purchases of goods and services like defense, education, healthcare, and public safety.

- Investment Spending: Expenditures on infrastructure projects, research and development, and capital goods.

- Transfer Payments: Payments like social security, unemployment benefits, and subsidies that affect the distribution of wealth rather than directly contributing to goods or services.

- Economic Role of Government Spending:

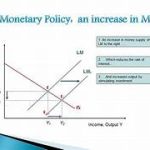

- Fiscal Policy Tool: Used by governments to manage the economy through expansionary or contractionary policies.

- Stimulus during Recessions: Often employed to combat economic downturns, such as through stimulus packages or public works programs.

- Investment in Infrastructure: Long-term projects (roads, education, healthcare) to boost productivity.

Theoretical Basis of Government Spending and Economic Growth

- Keynesian Economics:

- Government spending as a driver of aggregate demand: According to Keynesian theory, in times of economic slack, government spending can increase aggregate demand, stimulate production, and reduce unemployment, leading to economic growth.

- Multiplier effect: Increased government expenditure leads to increased income and consumption, which in turn stimulates further demand and economic growth.

- Classical Economics:

- Government spending as potentially inflationary: Classical economists argue that government spending can crowd out private investment and lead to inflation if it is not offset by a reduction in private sector activity.

- Limited long-term impact: Classical theory suggests that government spending has a limited effect on long-term growth, which is determined more by factors like technological progress and capital accumulation.

- Modern Perspectives:

- Endogenous Growth Theory: Suggests that government spending on education, infrastructure, and innovation can enhance long-term economic growth by improving human capital and productivity.

- Crowding-in vs. Crowding-out: Depending on the efficiency and allocation of government spending, it can either crowd in private investment (enhancing growth) or crowd out private investment (hindering growth).

Empirical Evidence on the Impacts of Government Spending

- Short-Term Economic Growth:

- Case studies from the 2008 Financial Crisis: Many countries, including the United States and European Union nations, implemented massive government spending packages to stabilize their economies. Empirical studies suggest that these stimulus measures played a key role in accelerating recovery.

- Government spending as a response to recessions: Research indicates that in times of economic recessions, government spending can act as a powerful tool to offset declining private sector demand and reduce unemployment.

- Long-Term Economic Growth:

- Investment in Infrastructure: Numerous studies have shown that government spending on infrastructure (such as roads, bridges, and public transport systems) has a positive effect on long-term productivity and economic growth. Countries that have made substantial investments in infrastructure have experienced higher growth rates.

- Education and Human Capital: Empirical studies on government spending on education and healthcare reveal a direct link between these investments and long-term economic growth. Countries with high-quality education systems and public health outcomes tend to experience more sustainable economic growth.

- Crowding Out vs. Crowding In:

- Crowding-out Effect: Some studies suggest that large government deficits can lead to higher interest rates, which crowd out private investment. For instance, in some advanced economies, fiscal deficits led to rising debt levels, reducing the funds available for private investment.

- Crowding-in Effect: On the other hand, empirical evidence from developing economies shows that strategic government spending, especially in infrastructure and technology, has been associated with increased private sector investment.

- Impact on Different Economies:

- Developing vs. Developed Economies: Empirical analysis has shown that government spending tends to have a more significant effect on economic growth in developing countries than in developed economies. This is because developing nations often lack adequate infrastructure, education, and health systems, where public investments can have a high return.

- Fiscal Multiplier in Low-Interest Rate Environments: In situations where interest rates are already low, studies suggest that the fiscal multiplier effect of government spending is higher, meaning that additional government expenditure has a more pronounced effect on economic growth.

Challenges and Risks of Government Spending

- Fiscal Deficits and National Debt:

- Sustainability of government debt: One of the main risks associated with high levels of government spending is the accumulation of national debt. If government debt becomes unsustainable, it can lead to higher interest payments, which might limit the government’s ability to continue spending.

- Debt-to-GDP ratio: High government spending without adequate revenue generation can lead to an increasing debt-to-GDP ratio, which might hurt investor confidence and lead to higher borrowing costs.

- Inefficiency in Spending:

- Wasteful spending: If government spending is not efficiently allocated, it can lead to waste and inefficiency. Empirical studies have shown that corruption and poor governance can reduce the effectiveness of government spending.

- Misallocation of resources: When government spending is directed toward unproductive areas, it can lead to economic distortions and a misallocation of resources.

- Inflationary Pressures:

- Inflation risk: Excessive government spending, especially in an economy with a full or near-full employment, can lead to inflationary pressures. This has been observed in economies where government expenditure outpaces the economy’s capacity to produce goods and services.

Government Spending in Practice: Case Studies

- United States Stimulus Packages (2008 and 2020):

- 2008 Financial Crisis: The U.S. government passed a $787 billion stimulus package that significantly boosted the economy. Studies indicate that the stimulus helped reduce the severity of the recession and accelerated recovery.

- COVID-19 Pandemic Response: In 2020, the U.S. government introduced an additional $2 trillion in economic relief packages. Empirical analysis shows that this government spending was pivotal in preventing deeper economic damage during the pandemic, though concerns about future inflation and national debt remain.

- China’s Infrastructure Spending:

- Rapid Economic Growth: China’s massive government spending on infrastructure has been a significant driver of its rapid economic growth over the last few decades. Studies suggest that China’s public investments in roads, railways, and urban development have been crucial in lifting millions out of poverty.

- European Union’s Investment in Green Energy:

- EU Green Deal: The EU has committed significant government spending to transition to a green economy through its Green Deal. Empirical evidence suggests that these investments will not only reduce emissions but also stimulate job creation and long-term growth in renewable energy sectors.

Conclusion

- Summary of Findings: Government spending has both short-term and long-term effects on economic growth. In the short term, it can stimulate demand, reduce unemployment, and mitigate economic downturns. In the long term, investments in infrastructure, education, and healthcare can foster sustainable growth. However, the effects of government spending are contingent on the efficiency of the spending and the fiscal sustainability of the government.

- Policy Recommendations: Governments should focus on directing spending toward productive areas that enhance economic potential, such as infrastructure, innovation, and human capital development, while also managing debt levels to avoid long-term fiscal crises.

- Final Thoughts: While government spending can significantly contribute to economic growth, careful planning, prioritization, and efficiency are crucial to ensuring that it leads to positive, sustainable outcomes.