AI for Managing Cryptocurrency Market Volatility

The cryptocurrency market has been a focal point of innovation and speculation in modern finance. Characterized by extreme volatility, it presents immense opportunities and significant risks for investors. Unlike traditional financial markets, cryptocurrencies operate 24/7, lack centralized oversight, and are influenced by unique factors such as blockchain technology developments, regulatory announcements, and social media trends.

In this dynamic environment, Artificial Intelligence (AI) has emerged as a critical tool for managing volatility, enabling investors and institutions to navigate the complexities of cryptocurrency trading. This article explores how AI is transforming the approach to cryptocurrency market volatility, discussing its applications, benefits, challenges, and the future of AI-driven crypto market management.

Understanding Cryptocurrency Market Volatility

Cryptocurrency prices are known for their wild fluctuations. For example, Bitcoin’s price surged from $4,000 in March 2020 to over $60,000 in April 2021, only to drop significantly months later. Similar patterns are observed in other cryptocurrencies like Ethereum, Solana, and Dogecoin.

Key factors contributing to this volatility include:

- Speculative Trading: Investors often buy and sell cryptocurrencies based on short-term price predictions, amplifying price swings.

- Regulatory Uncertainty: Announcements from governments and regulatory bodies can cause abrupt market reactions.

- Liquidity Constraints: Many cryptocurrencies have lower trading volumes than traditional assets, making them more susceptible to price changes.

- Market Sentiment: News, social media trends, and influencer endorsements can trigger sudden price movements.

These challenges necessitate sophisticated tools for market analysis and decision-making, and AI has proven to be a game-changer in this regard.

Applications of AI in Managing Cryptocurrency Market Volatility

AI has introduced advanced capabilities that help investors and institutions better understand, predict, and respond to cryptocurrency market volatility.

1. Predictive Analytics

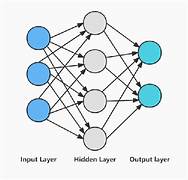

AI leverages machine learning models to analyze historical price data, market trends, and external factors such as macroeconomic indicators. By identifying patterns and correlations, these models provide forecasts for future price movements.

For instance, AI can predict how Bitcoin might respond to a Federal Reserve interest rate hike or a major technological upgrade like Ethereum’s transition to proof-of-stake.

2. Sentiment Analysis

Cryptocurrency prices are heavily influenced by market sentiment, often reflected in social media, news articles, and online forums. AI-powered sentiment analysis tools scan these platforms in real-time to gauge public opinion and predict market movements.

For example, an AI system can detect increased positive sentiment around a cryptocurrency due to a favorable news article and suggest a buy signal before prices rise.

3. Automated Trading Algorithms

AI-driven trading bots execute trades based on pre-defined criteria, such as price thresholds, volume changes, or market sentiment. These bots operate 24/7, capitalizing on opportunities even when human traders are unavailable.

High-frequency trading (HFT), enabled by AI, is particularly effective in the crypto market, where speed is crucial to exploiting short-term price inefficiencies.

4. Risk Management

AI enhances risk management by monitoring portfolios in real-time and suggesting adjustments based on market conditions. For example, an AI system might recommend reallocating assets to stablecoins or diversifying into less volatile cryptocurrencies during market downturns.

5. Fraud Detection and Security

AI identifies suspicious activities, such as pump-and-dump schemes or fraudulent transactions, which can destabilize the market. By analyzing transaction patterns and flagging anomalies, AI ensures a safer trading environment.

6. Portfolio Optimization

AI uses optimization algorithms to create balanced portfolios that align with an investor’s risk tolerance and financial goals. These tools dynamically adjust the portfolio as market conditions change, ensuring consistent performance.

7. Market Impact Analysis

AI assesses how large trades or news events might impact the market, helping traders make more informed decisions. For instance, if a whale investor sells a significant amount of Bitcoin, AI can predict the likely impact on market prices and suggest strategies to mitigate losses.

Benefits of Using AI in the Cryptocurrency Market

AI brings numerous advantages to managing cryptocurrency market volatility:

1. Enhanced Decision-Making

AI provides data-driven insights, reducing reliance on intuition and enabling more accurate decisions.

2. Real-Time Analysis

AI processes vast amounts of data in real-time, ensuring that traders and investors are always informed of the latest market developments.

3. Improved Efficiency

AI automates routine tasks such as trade execution, portfolio monitoring, and risk assessment, allowing traders to focus on strategy and innovation.

4. Reduced Emotional Bias

Emotions often drive poor investment decisions. AI eliminates this bias by making objective recommendations based on data and algorithms.

5. Accessibility

AI-powered tools, such as robo-advisors and automated trading platforms, democratize access to sophisticated trading strategies, enabling retail investors to compete with institutional players.

6. Risk Mitigation

AI’s ability to predict market downturns and suggest protective measures helps investors minimize losses during periods of high volatility.

Challenges of AI in Cryptocurrency Market Management

While AI offers immense potential, its application in the cryptocurrency market is not without challenges:

1. Data Quality and Availability

Cryptocurrency data can be fragmented and inconsistent, impacting the accuracy of AI models.

2. Model Overfitting

AI models trained on historical data may struggle to adapt to unforeseen market events or changes in market dynamics.

3. High Computational Costs

AI systems require significant computational resources, which can be expensive for individual investors or small firms.

4. Cybersecurity Risks

AI systems are vulnerable to hacking and manipulation, which could lead to financial losses or compromised trading strategies.

5. Regulatory Concerns

The use of AI in trading raises questions about compliance with evolving cryptocurrency regulations and ethical considerations.

Future of AI in Cryptocurrency Market Management

The integration of AI in the cryptocurrency market is expected to deepen, with several exciting developments on the horizon:

1. Advanced Natural Language Processing (NLP)

NLP will enable AI systems to analyze unstructured data, such as regulatory documents or earnings reports, with greater accuracy, enhancing market predictions.

2. Quantum Computing

Quantum computing could revolutionize AI in cryptocurrency trading by processing complex calculations and datasets at unprecedented speeds.

3. Integration with Blockchain

AI and blockchain technologies will synergize to enhance transparency, traceability, and security in cryptocurrency markets.

4. Personalized Trading Strategies

AI will offer hyper-personalized trading recommendations, tailoring strategies to individual preferences, risk profiles, and financial goals.

5. Enhanced Risk Prediction Models

Future AI systems will incorporate more diverse data sources, such as global economic indicators and geopolitical events, to provide comprehensive risk assessments.

Conclusion

AI is revolutionizing how cryptocurrency market volatility is managed, offering tools and strategies that enhance decision-making, reduce risks, and improve overall market efficiency. From predictive analytics and sentiment analysis to automated trading and risk management, AI-powered solutions are empowering investors to navigate the complexities of the cryptocurrency landscape.

While challenges such as data quality, computational costs, and regulatory compliance remain, the benefits of AI far outweigh its limitations. As technology continues to evolve, AI will play an increasingly central role in shaping the future of cryptocurrency trading, ensuring a more stable and inclusive financial ecosystem.

In a market defined by unpredictability, AI stands as a beacon of innovation and reliability, transforming the way we understand and interact with digital assets.